“The economy is not sending any signals that we need to be in a hurry to lower rates.” These words from Chairman Powell impacted the stock market much more than this week’s inflation data.

The stock market started selling off on Thursday afternoon and continued to do so Friday, with the broader stock market indexes closing lower. The Dow Jones Industrial Average ($INDU) closed down by 0.70%, the S&P 500 lower by 1.32%, and the Nasdaq Composite ($COMPQ) lower by 2.2%.

It’s also options expiration Friday, which generally means increased volatility. The Cboe Volatility Index ($VIX) gained 12.79% on Friday, closing at 16.14. That’s a big jump from earlier in the week.

Nasdaq’s Fierce Selloff

The Nasdaq experienced the biggest drop of the three indexes. The chip makers got smoked. Applied Materials (AMAT), the largest US chipmaker, was down 8.76% on a disappointing revenue forecast. Nvidia (NVDA) was down over 3%, Micron Technology (MU) was down almost 3%, and Intel (INTC) fell 1.70%.

The daily chart of the VanEck Vectors Semiconductor ETF (SMH) gives a clear picture of the semiconductor industry.

FIGURE 1. DAILY CHART OF THE VANECK VECTORS SEMICONDUCTOR ETF (SMH). The sharp selloff in semiconductor stocks resulted in a technical weakness in the chart of SMH. It’s close to a support level, while its SCTR score, MACD, and relative strength with respect to the S&P 500 weaken.Chart source: StockChartsACP. For educational purposes.

Although SMH is still within the sideways range (grey rectangle), it’s very close to the bottom of the range, which aligns with the 200-day simple moving average (SMA). The StockCharts Technical Rank (SCTR) score is at a low 29, the moving average convergence/divergence (MACD) indicates a lack of momentum, and SMH is not outperforming the S&P 500 like it once did.

Looks like investors are rotating away from semiconductors, either taking profits or investing in other asset classes — but which ones? It’s certainly not healthcare stocks, which also got pounded on Friday. Perhaps cryptocurrencies. However, there’s more brewing beneath the surface.

The Yield Rally

The economy is still strong—retail sales data shows that consumers continue to spend, which is pushing Treasury yields higher. The 10-year US Treasury Yield Index ($TNX) closed at 4.43% (see daily chart below). TNX has been trending higher since mid-September and since the end of September has been trading above its 20-day SMA.

FIGURE 2. DAILY CHART OF THE 10-YEAR US TREASURY YIELD. Treasury yields have been on a relentless yield since September. A stronger US economy would keep yields higher.Chart source: StockChartsACP. For educational purposes.

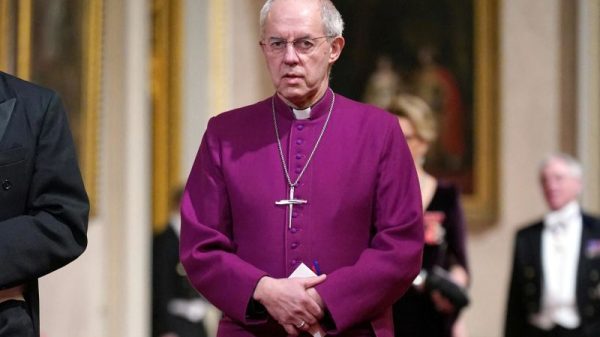

Fed Chairman Powell and Boston Fed President Susan Collins’ comments lowered the probability of a 25-basis-point interest rate cut in the December FOMC meeting. According to the CME FedWatch Tool, the probability is now 58.2%. It was close to 70% on Thursday, before Powell’s speech.

The relentless yield rally may have been one reason the Tech sector sold off. Higher yields don’t benefit growth stocks.

Dollar’s Roaring Rally

One asset class that is gaining ground is the US dollar. When the words “Dollar sets 52-week high” appear in my predefined alerts dashboard panel, it’s something to analyze. The US dollar ($USD) has been in a relatively steep rally since October (see chart below). With a strong US economy and the Fed indicating a more neutral stance in their policy decisions, the dollar could continue to strengthen.

FIGURE 3. DAILY CHART OF THE US DOLLAR. The dollar has been in a roaring rally since October. A strong US economy supports a strong dollar.Chart source: StockChartsACP. For educational purposes.

At the Close

With the exception of the Dow, the other broader indexes have fallen to the lows of November 6, the day after the US presidential election. The broad-based selloff could continue into early next week. There’s not much economic data for next week, but Nvidia will announce earnings after the close on Wednesday. That should shake up the chip stocks.

If you have cash on the sidelines, there could be some “buy the dip” opportunities. However, because there are some dynamics between stocks, yields, and the US dollar, the three charts should be monitored to identify signs of a reversal. When you’re confident of a reversal, jump on board.

If you want to be notified of new articles published in the ChartWatchers blog, sign up on this page.

End-of-Week Wrap-Up

- S&P 500 down 2.08% for the week, at 5870.62, Dow Jones Industrial Average down 1.24% for the week at 43,444.99; Nasdaq Composite down 3.15% for the week at 18,680.12

- $VIX up 8.03%% for the week, closing at 16.14

- Best performing sector for the week: Financials

- Worst performing sector for the week: Health Care

- Top 5 Large Cap SCTR stocks: Applovin Corp. (APP); Palantir Technologies (PLTR); Summit Therapeutics (SMMT); MicroStrategy Inc. (MSTR); Redditt Inc. (RDDT)

On the Radar Next Week

- October Housing Starts

- November Michigan Consumer Sentiment

- Fed speeches

- Nvidia earnings

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.